To the extent that historical press releases reference BMW Manufacturing Co., LLC as the manufacturer of certain X model vehicles, the referenced vehicles are manufactured in South Carolina with a combination of U.S. origin and imported parts and components.

PressClub USA · Article.

Robust results within full-year guidance: BMW Group has a successful start to 2024

Wed May 08 17:25:00 CEST 2024 Press Release

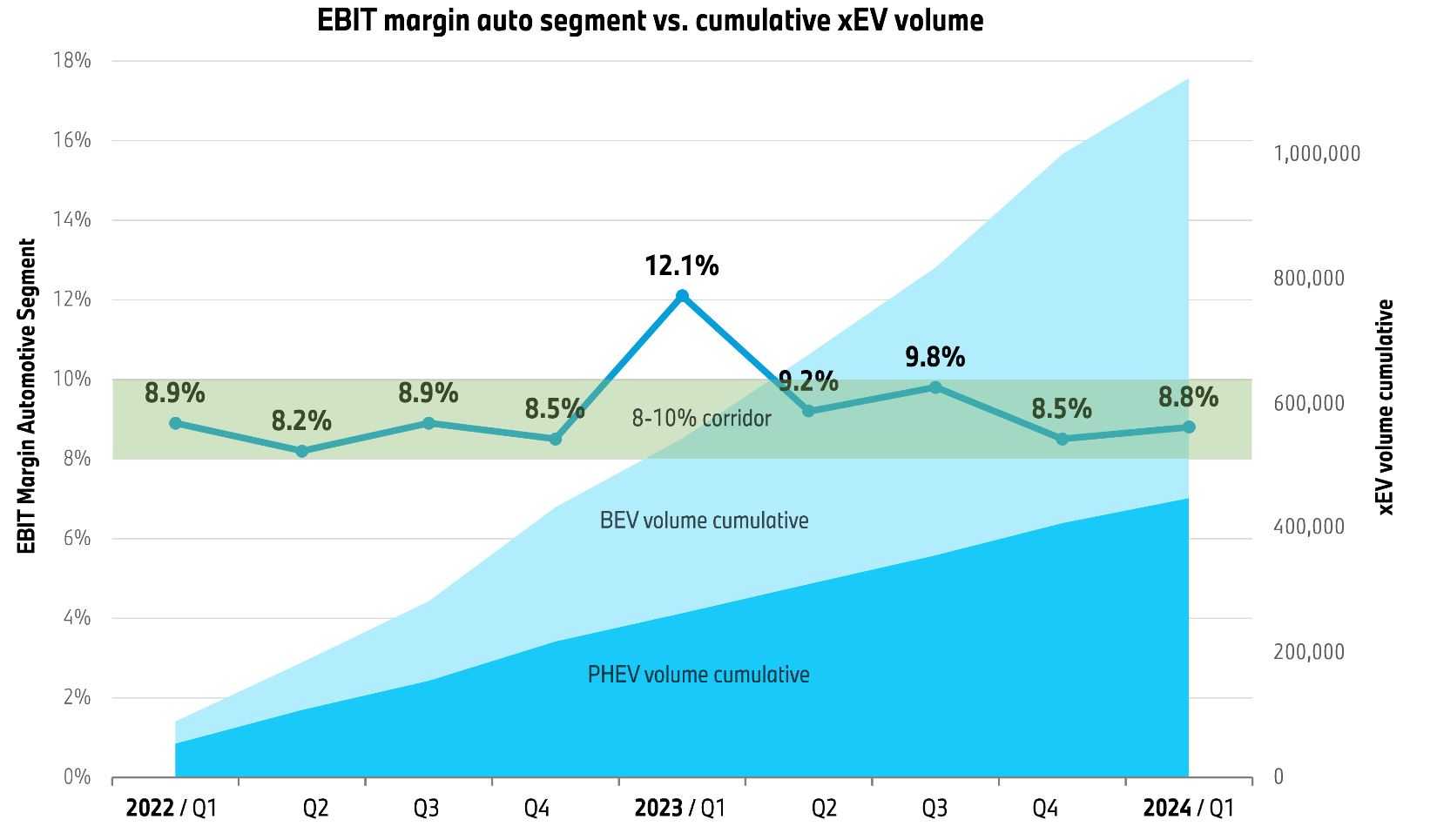

+++ Consistent strategic implementation: Dynamic BEV ramp-up aligned with profitability, as planned +++ BEV ramp-up continued as planned: 28% growth to around 83,000 BEVs in Q1 +++ BMW brand sales increased by 2.5% +++ Deliveries of models in the upper price segment rise by over 20% +++ Group EBT margin above target of >10% in Q1 +++ EBIT margin within the target range of 8-10% for nine consecutive quarters +++ Outlook for 2024 confirmed +++

Press Contact.

Phil DiIanni

BMW Group

Tel: +1-201-571-5660

send an e-mail

Author.

Phil DiIanni

BMW Group

Related Links.

Munich. The BMW Group continues its successful course in 2024: parallel to its dynamic BEV ramp-up, the company achieved its margin targets. In the first three months of the year, the company delivered around 83,000 all-electric vehicles from its BMW, MINI and Rolls-Royce brands and increased BEV sales by around 28 percent. The BMW brand overall increased its sales by 2.5%. At the same time, the EBIT margin in the Automotive segment of 8.8 percent was within the target range of 8-10 percent, according to the full-year guidance. At 11.4 percent, the EBT margin at Group level was above the strategic target of >10 percent.

After the challenges of the corona pandemic and semiconductor availability, the company has consistently delivered quarter by quarter within its 8-10% strategic EBIT corridor since Q1 2022. This has been achieved in parallel to its rapid ramp-up of electric mobility: Over the past two years, the BMW Group delivered more than 1.1 million electrified vehicles to customers. More than 60 percent of these were purely electric BEV models. The BEV share continues to rise steadily, as planned.

In the first quarter of 2023, the EBIT margin of Automotive segment was 12.1%. The EBIT of previous year’s first quarter benefited from the lower purchase price level of 2022, as inventories with lower manufacturing costs were sold. The inflation-related increase in manufacturing costs impacted the profit & loss statement of BMW AG after the second quarter of 2023. The higher cost level has carried through into Q1/2024.

“The past nine quarters underline BMW’s continuity and reliability: As planned, we are dynamically expanding the share of electric vehicles while maintaining our high level of profitability. Some call this transformation — for us, it is continuous progress,” said the Chairman of the Board of Management of BMW AG, Oliver Zipse, on Wednesday. “We will remain on this course: We offer our customers the latest innovations and the latest technology — across all vehicle drivetrains. As a result, we continue to generate strong demand with strong products.”

Automotive markets on upward trend – BMW Group deliveries increase

With a total of 594,533 automobiles delivered to customers in the first three months, the company posted a slight growth of 1.1% compared to the previous year and reaffirmed its leading position in the global premium segment.

Throughout the three-month period, the major automotive markets largely showed an upward trend based on catch-up purchases and increased sales in the mid-price volume segment. The BMW Group benefited with its young and highly attractive product line-up: The BMW brand sold 530,933 units in the first quarter – an increase of +2.5% year-on-year. It achieved sales growth of 2.4% (84,475 units) in the USA and significant growth of 10.2% in Europe with 188,863 units delivered. In China, the volume segment developed dynamically in lower price ranges, while the premium segment declined slightly. The BMW brand sold 182,998 vehicles, in line with segment development (2023: 190,774 units/-4.1%). In Germany, deliveries grew by 4.6% to 49,509 premium vehicles.

The popular BMW i4*, as well as the BMW iX1* and BMW i7*, were among the biggest growth drivers of the 78,682 BMW BEVs delivered. The BMW brand’s fully-electric vehicles saw particularly strong growth of +40.6%. A total of 122,582 BMW Group electrified vehicles, BEVs and PHEVs, were delivered to customers, which represents a sales share of almost 21%.

Further sales momentum is expected over the course of the year from the BMW iX2* and BMW i5*, which are currently ramping up.

Fully-electric models increased to 13.9% of total sales (2023: 11.0%). Once again, the models of upper price segments also proved to be important growth drivers – with deliveries up 21.6%.

The MINI brand is undergoing a comprehensive model changeover. For the first time, the new MINI Countryman*, was recently launched with a pure-electric drive train alongside the familiar internal combustion engine. This will be followed by the new MINI Cooper*, which comes in mid Q2 with a combustion engine or as a fully-electric vehicle. The all electric MINI Aceman* recently celebrated its world premiere at the Beijing Motor Show and is the brand’s first cross-over model for the premium small car segment. These new models are expected to deliver additional momentum from 2nd half of 2024. MINI delivered 62,075 vehicles to customers in Q1 (2023: 68,541 units/-9.4%).

The Rolls-Royce brand made an impressive e-mobility debut with the Rolls-Royce Spectre*: In the first quarter of 2024 alone, the Rolls-Royce luxury brand handed over 579 fully-electric super coupés to their new owners; 38% of the total 1,525 cars delivered were electrified (2023: 1,640 automotive/-7.0%).

Currency-adjusted Group revenues increased slightly

First-quarter Group revenues totalled € 36,614 millionand were, therefore, on par with the previous year’s record high (2023: € 36,853 million/-0.6%). Group revenues were buoyed by higher sales volumes and a more favourable product mix.

Group EBT margin outperforms target of >10%

Between January and March, the BMW Group reported pre-tax earnings (EBT) of € 4,162 mi llion(2023: € 5,129 million/-18.9%). The EBT includes a financial result of € 108 million (2023: € -246 million), which reflects the market development in interest rate and currency hedging transactions. The EBT margin for this period was 11.4% (2023: 13.9%) and was above the >10% full year target. Group net profit for the first quarter totalled € 2,951 million (2023: € 3,662 million/-19.4%).

BMW AG continues its share buyback programme

With the authorisation of the Annual General Meeting of BMW AG on 11 May 2022, the company initiated the purchase of shares. Shares purchased in programme one have already been cancelled. As of 31 March 2024, BMW AG holds 8,004,314 treasury shares, with a nominal value of € 8,004,314. Based on this authorisation, BMW AG purchased shares equivalent to 5.03% of the share capital as of March 31, 2024.

8.8% Automotive Segment EBIT margin within full-year target range

The Automotive Segment earned revenues of € 30,939 million in the first quarter (2023: € 31,268 million/-1.1%). Excluding currency translation headwinds, especially from the Chinese renminbi and the US dollar, revenues posted year-on-year growth of +1.5%. Higher sales volumes and more favourable product mix effects from the upper price segment and BEV bolstered segment revenues, underscoring the robust operating performance of the core business. Prices across the product range are expected in 2024 to be in line with last year’s level.

The Ea rnings before financial result (EBIT) totalled € 2,710 million for the first quarter (2023: € 3,777 million/-28.2%). The auto EBIT margin came in at 8.8% (2023: 12.1%) and was thus within the full-year target range of 8-10%. EBIT was impacted by higher manufacturing costs. As mentioned before, Q1 2023 had still benefited from the lower level of purchasing prices in 2022. Manufacturing costs increased starting with the second quarter of 2023 and has carried through into Q1/2024.

Changes in commodity prices accounted for a positive low three-digit million euro impact in EBIT, while currency effects remained neutral. For the full year 2024, the BMW Group anticipates a positive net balance from currency and commodity positions.

Resale results from end-of-lease vehicles proved to be a headwind against Q1/2023 yet remained positive. Starting with the second quarter of 2023, the competitive environment has intensified due to a better availability of vehicles. This has led to a gradual softening of the global price environment in the new and used car business which has continued into the first quarter of 2024.

For the full year 2024, the company expects net impact of volume, product mix and price to be slightly positive against the previous year, as communicated.Additional momentum should come from the new 5 series and the better availability of the 7 series models within the first full year leading to a stronger product mix.

EBIT of auto segment was also impacted by higher selling & administrative costs,

largely due to IT projects and the increase in personnel costs, which was implemented from the third quarter of 2023.

In line with its strategic plans, the BMW Group is investing more in its future this year than ever before. It plans to see record levels of R&D expenses and capital expenditure: The BMW Group is consistently focusing on innovations, efficient and low-emission technologies, as well as the further electrification and digitalisation of the product range and the company.

Based on the strength of its current operating performance, the BMW Group incurred R&D expenses of € 1,974 millio n (2023: € 1,554 million/+ 27.0%) in the first quarter, which were significantly higher than the previous year. Spending was mainly focused on further electrification and digitalisation of the vehicle fleet, as well as continued development of automated driving functions. Development expenditure was also directed towards upcoming models of the NEUE KLASSE as well as successor models such as the BMW X5.

The R&D ratio (according to the German Commercial Code) increased to 5.4% (2023: 4.2%). For the full-year, the BMW Group expects a ratio of over 5.0%.

In the first quarter of the year, free cash flow of automotive segment was affected by the increase in working capital due to higher inventory levels to ensure appropriate supply to sales markets with lead times acceptable to customers.

Capital expenditure of € 1,323 million (excluding captialized development costs)was allocated to facilities including facilities for vehicle projects, with a focus on electrification and digitalisation (2023: € 1,328 million/-0.37%). The capex ratio stood at 3.6% (2023: 3.6%). The company expects the ratio for the full year to be over 6%.

In Q1 2024, total investments of €2.3bn were made into future models and innovations. Nevertheless, segment Automotive generated € 1,283 million (2023: € 1,981 million/-35.2%) in free cash flow.

For the full year, the BMW Group is targeting a free cash flow in the Automotive Segment above € 6 billion, despite peak investments in R&D and CAPEX in 2024.

“A long-term strategic approach, coupled with maximum flexibility in our day-to-day business and a clear focus on profitability – that is what defines the BMW Group's strong operating performance. With this strength, we are in a good position for our company's far-reaching transition with a diverse range of electrified and digitalized products. This year, it will be more important than ever to maintain our strategic course. The investments needed in the digital and electric future of our company are the highest they have ever been,” said Walter Mertl, member of the Board of Management responsible for Finance. “We are confident about the future – because we are building on our highly attractive products and brands and on our financial strength.”

Financial services see strong growth in new business

The financing and leasing business of BMW Group Financial Services continued to experience dynamic development in the first quarter of 2024. New retail business with end customers saw strong growth: The number of new contracts climbed by 21.5% to reach a total of 422,056 (2023: 347,298 contracts).

The corresponding total volume of new business from financing and leasing contracts with retail customers was € 15,620 million (2023: € 12,788 million/+22.1%). The percentage of BMW Group new vehicles leased or financed by the Financial Services Segment reached 41.8% at the end of the first quarter (2023: 36.5%/+5.3 percentage points).

In the three-month period, the segment reported pre-tax earnings of € 730 m illion(2023: € 945 million/-22.8%). Higher risk provisioning and lower income from the resale of end-of-lease vehicles had a dampening effect on earnings against the previous year. As anticipated, prices in the used car markets continued to decline. During the reporting period, the credit loss ratio remained at the low rate of 0.21% across the entire loan portfolio (2023: 0.13%). BMW Group Financial Services has made adequate risk provisions.

BMW motorcycles with strong season start

In the first quarter, BMW Motorrad delivered 46,434 motorcycles and scooters to customers. Overall, BMW Motorrad expects demand for its young product line-up to remain robust this year. The new models, especially the F 800 GS, the F 900 GS and the R 1300 GS, are enjoying strong demand since their market launch, further bolstering the segment's growth strategy. The EBIT margin of 12.2%(2023: 16.5%) exceeded the guided full-year target range of 8-10%.

BMW Group confirms guidance

Forecasts predict a slight increase of 3.2% in global economic growth for 2024. If the current economic recovery in many markets continues, growth could potentially be stronger. However, escalation of existing conflicts, with a possible increase in geopolitical tensions, could have a negative impact.

The BMW Group expects to participate in this growth, leveraging its balanced positioning across the world’s major regions.

Given the continuing demand for its attractive premium vehicles, the BMW Group confirms its guidance for the year. The company expects to see slight growth in customer deliveries worldwide in 2024.

Group earnings before tax are forecast to decrease slightly, due to higher manufacturing and fixed costs, particularly personnel costs and R&D expenses, compared to the previous year. The projected decrease in used car prices is also anticipated to contribute to this development.

The BMW Group expects an EBIT margin in the Automotive Segment of between 8-10% for the full year.

For the Motorcycles Segment, a slight increase in deliveries is forecast and an EBIT margin within the target range of 8-10%.

Return on equity (RoE) in the Financial Services Segment is projected to be between 14 and 17%.

These targets will be achieved with slightly higher employee numbers.

This guidance assumes that geopolitical and macroeconomic conditions will not deteriorate substantially. Given the many uncertainties surrounding the existing risks and opportunities, the BMW Group’s actual business performance may deviate from current expectations.

The BMW Group – an overview: IN Q1 2024 |

| Q1 2024 | Q1 2023 | Change in % |

Deliveries to customers |

|

|

|

|

Automotive1 | units | 594,533 | 588,138 | 1.1 |

thereof: BMW | units | 530,933 | 517,957 | 2.5 |

MINI | units | 62,075 | 68,541 | -9.4 |

Rolls-Royce | units | 1,525 | 1,640 | -7.0 |

Motorcycles | units | 46434 | 47,935 | -3.1 |

|

|

|

|

|

Employees (as of 31 Dec. 2023) |

| 154,950 |

|

|

EBIT margin Automotive Segment | percent | 8.8% | 12.1% | -27.5 |

EBIT margin Motorcycles Segment | percent | 12.2% | 16.5% | -26.4 |

EBT margin BMW Group2 | percent | 11.4% | 13.9% | -18.0 |

|

|

|

|

|

Revenues | € million | 36,614 | 36,853 | -0.6 |

thereof: Automotive | € million | 30,939 | 31,268 | -1.1 |

Motorcycles | € million | 872 | 933 | -6.5 |

Financial Services | € million | 9,525 | 8,826 | 7.9 |

Other Entities | € million | 4 | 3 | 33.3 |

Eliminations | € million | -4,726 | -4,177 | 13.1 |

|

|

|

|

|

Profit before financial result (EBIT) | € million | 4,054 | 5,375 | -24.6 |

thereof: Automotive | € million | 2,710 | 3,777 | -28.2 |

Motorcycles | € million | 106 | 154 | -31.2 |

Financial Services | € million | 714 | 958 | -25.5 |

Other Entities | € million | -5 | -4 | 25.0 |

Eliminations | € million | 529 | 490 | 8.0 |

|

|

|

|

|

Profit before tax (EBT) | € million | 4,162 | 5,129 | -18.9 |

thereof: Automotive | € million | 2,703 | 3,828 | -29.4 |

Motorcycles | € million | 106 | 154 | -31.2 |

Financial Services | € million | 730 | 945 | -22.8 |

Other Entities | € million | 401 | -128 | -413.3 |

Eliminations | € million | 222 | 330 | -32.7 |

|

|

|

|

|

Group income taxes | € million | -1,211 | -1,467 | -17.5 |

Net profit | € million | 2,951 | 3,662 | -19.4 |

Earnings per share of common stock | € | 4.42 | 5.31 | -16.8 |

Earnings per share of preferred stock3 | € | 4.42 | 5.31 | -16.8 |

1 Deliveries include the joint venture BMW Brilliance Automotive Ltd., Shenyang | ||||

2 Ratio of Group earnings before taxes to Group revenues. | ||||

3 Common/preferred shares. Earnings per share of preferred stock are calculated by distributing the earnings required to cover the additional dividend of € 0.02 per preferred share proportionally over the quarters of the corresponding financial year. | ||||

GLOSSARY – explanatory comments on key performance indicators

Deliveries to customers

A new or used vehicle is recorded as a delivery once it is

handed over to the end user (which also includes leaseholders under

lease contracts with BMW Financial Services). In the US and Canada,

end users also include (1) dealers when they designate a vehicle as a

service loaner or demonstrator vehicle and (2) dealers and other third

parties when they purchase a company vehicle at auction and dealers

when they purchase company vehicles directly from the BMW Group.

Deliveries may be made by BMW AG, one of its international

subsidiaries, a BMW Group retail outlet, or independent third-party

dealers. The vast majority of deliveries – and hence the reporting of

deliveries to the BMW Group – is made by independent third-party

dealers. Retail vehicle deliveries during a given reporting period do

not correlate directly to the revenues that the BMW Group recognises

in respect of that particular reporting period.

EBIT

Profit before financial result. Profit before financial result comprises revenues less cost of sales, less selling and administrative expenses and plus/minus net other operating income and expenses.

EBIT margin

Profit/loss before financial result as a percentage of revenues.

EBT

EBIT plus financial result.

PHEV

Plug-in-hybrid electric vehicle.

If you have any questions, please contact:

BMW Group Corporate Communications

Dr Britta Ullrich, Finance Communications

Telephone: +49 89 382-18364

Email: britta.ullrich@bmwgroup.com

Eckhard Wannieck, head of Communications BMW Group, Finance, Sales

Telephone: +49 89 382-24544

Email: eckhard.wannieck@bmwgroup.com

Media website: www.press.bmwgroup.com/deutschland

Email: presse@bmwgroup.com

The BMW Group

With its four brands BMW, MINI, Rolls-Royce and BMW Motorrad, the BMW Group is the world’s leading premium manufacturer of automobiles and motorcycles and also provides premium financial and mobility services. The BMW Group production network comprises over 30 production sites worldwide; the company has a global sales network in more than 140 countries.

In 2023, the BMW Group sold over 2.55 million passenger vehicles and more than 209,000 motorcycles worldwide. The profit before tax in the financial year 2023 was € 17.1 billion on revenues amounting to € 155.5 billion. As of 31 December 2023, the BMW Group had a workforce of 154,950 employees.

The success of the BMW Group has always been based on long-term thinking and responsible action. The company set the course for the future at an early stage and consistently makes sustainability and efficient resource management central to its strategic direction, from the supply chain through production to the end of the use phase of all products.

www.bmwgroup.com

Facebook: http://www.facebook.com/BMWGroup

Twitter: http://twitter.com/BMWGroup

YouTube: http://www.youtube.com/BMWGroupView

Instagram: https://www.instagram.com/bmwgroup

LinkedIn: https://www.linkedin.com/company/bmw-group/